During the a house investing, timing is everything you, and you can a trending seller’s market demands small approvals and you can legitimate financing – this is when DSCR loans are located in. Often referred to as money spent fund, non-QM finance, and you will rental financing , DSCR finance was preferred between a home investors seeking expand its local rental portfolios.

Capital for rent property financial investments

Investing in rental services is certainly believed a sound financing. You to definitely belief continues to keep real since occupant request, occupancy profile, rental income increases, and assets opinions rise. The current white-sizzling hot leasing marketplace is spurring major and you can amateur a house traders so you can size its local rental portfolios.

But looking for local rental attributes to add to the portfolio merely the first step. Opening flexible financing and a dependable lender to aid create your organization is integral. In the current field environment, it is far from simple to personal with the a beneficial local rental assets offer quickly instead of that.

Dealers can be beat old-fashioned funding’s rigid constraints and you can choose for an effective focused, goal-concentrated local rental money debt-service visibility proportion (DSCR) mortgage – that provides several simple keeps such as for example no difficult borrowing from the bank draws, money verifications, or rigid Fico scores to help you be considered.

What is a rental possessions (DSCR) financing?

A DSCR rental loan try an arduous money, no-income loan started according to the property’s projected earnings (as opposed to the borrower’s income, like with an everyday financial). DSCR financing give long-identity money to own a rental (buy-and-hold) investment strategy.

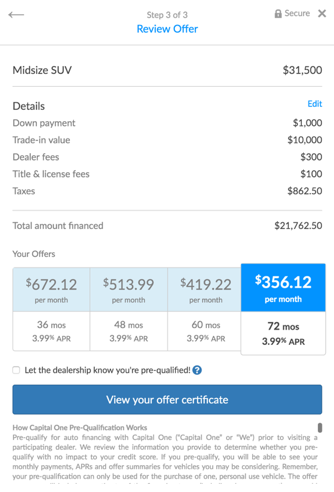

The debt-Provider Publicity proportion (DSCR) steps your ability to repay the loan. Instead of a vintage otherwise manager-filled mortgage loan, good DSCR loan actually underwritten predicated on your own money. Alternatively, it is underwritten centered on assets-height earnings. Such as a vintage mortgage, payday loans near me Georgia it entails an advance payment and a decent credit score and charges yearly appeal.

What’s Personal debt Provider Visibility Proportion (DSCR)?

Ahead of discovering the particulars of a rental assets mortgage, it’s advantageous to understand the computation and you will intent behind your debt service visibility ratio. Lenders utilize this proportion to determine when you yourself have sufficient funds to repay the debt. The lender will use this article to choose what kind of cash to give whenever requesting financing or refinancing a current that.

DSCR ‘s the ratio of money produced each $1 owed for the lender. The higher new ratio is actually, more websites doing work money is present so you can services your debt. Eg, a 1.25x DSCR shows that the resource produces $1.twenty-five each $step one due.

Quite simply, the new DSCR talks about the monthly personal debt costs with the the house, as well as mortgage money, and you will measures up these to the fresh new property’s monthly cash. The lower the latest DSCR, the more the chance you may have to go out of pocket to pay the borrowed funds if the property remain bare, and/or working expenditures grow to be greater than asked.

DSCR computation having an individual-family members rental possessions

A simple way to help you assess your DSCR and you may size finances move is always to separate the brand new month-to-month lease of the PITIA (dominating, fees, notice, insurance rates, and you will association dues). New ensuing ratio lends insight into what you can do to invest straight back the borrowed funds centered on the property’s month-to-month rental earnings.

Note: For every single bank may has a somewhat more kind of calculating DSCR, so it is far better require perfect quantity together with your financial.

Being qualified having an effective DSCR financing

Whenever being qualified getting a DSCR financing, the lending company takes into account several factors, including the borrower’s credit history, offered advance payment, plus the personal debt-solution publicity proportion of the property. Typically, the credit score decides the pace, and you will power depends on credit history and you may DSCR joint. DSCR methods the asset’s capacity to spend the money for property’s home loan and you may costs – therefore the higher it is, the greater amount of influence this new investor may, which means less out-of-pocket cash at closure.

- Minimum Credit rating Necessary: DSCR loan providers such as Kiavi tend to need a good 660 FICO Rating to possess pre-degree.

- Minimal Down payment or Equity: Restrict financing-to-well worth (LTV) towards the local rental finance varies from financial so you’re able to lender but may range out of 70%-80%, based property method of, borrowing from the bank and you will DSCR. The remainder will probably be your advance payment.

- Minimal Value of: Loan providers instance Kiavi enjoys the absolute minimum value of requirement of $75K.

What exactly is a great DSCR?

Lenders commonly consider an excellent “good” DSCR to get step one.twenty-five or higher because it signifies that the home yields twenty five% a lot more funds than expenditures and has an optimistic earnings as the long because it stays occupied.

New better youre to breaking even, the less money move it is possible to obtain regarding the property-for this reason therefore it is a good riskier money. Put differently, if the DCSR to the a specific contract is not at the least step one.0, your local rental money was lower than the overall personal debt service, so you create generate losses each month. Due to this fact it is essential to perform the math on every contract just before progressing-in this situation, preventing the price could possibly become finest.

Normal DSCR Loan Possibilities

Most tough currency loan providers offer repaired-rate, adjustable-rates, or notice-simply choices on the a DSCR loan. This enables you to select an educated conditions for the property bargain to maximise their monthly income. In addition, qualified (v) and you will ineligible (X) possessions models for a good DSCR financing tend to be: