Once you’ve located your dream house, you are able to complete an entire financial app. Sierra Pacific will guarantee debt information, and financial statements, tax returns, and you can a career background.

step 3. Underwriting

During the underwriting, Sierra Pacific will assess the likelihood of credit to you. This step is sold with an intense diving to your profit to be sure you might do the mortgage repayments.

4. Closure

In the event the all happens better inside underwriting, it is possible to proceed to the new closing techniques, where you’ll sign the final files and you will commercially secure the loan. To date, the borrowed funds funds is marketed, while obtain the keys to your brand new family!

- Credit score: While particular standards will vary, conventional money usually want a credit score of at least 620.

- Money Confirmation: Loan providers often make sure your revenue to make certain it is possible to make month-to-month mortgage repayments.

- Down payment: With respect to the brand of financing, their advance payment get cover anything from step three% to help you 20% of one’s home’s price.

Facts Interest rates and you can Loan Terms and conditions

When deciding on a mortgage, you’ll need to pick anywhere between repaired and changeable interest rates. Fixed costs continue to be a similar in the longevity of the loan, providing balance. Changeable rates, while doing so, can also be change according to markets standards, which could bring about lower costs to start with but may improve after.

What to expect Immediately following Pre-Acceptance

Once you’ve been pre-acknowledged, it is time to assemble and you will submit essential data. You will need to give pay stubs, taxation statements, bank statements, and other kinds of economic verification. Next happens the latest underwriting techniques, where your loan software is examined in detail.

Closure the borrowed funds which have Sierra Pacific

The closing processes would be courage-wracking, but Sierra Pacific guides your courtesy it every step of your own means online personal loans New York. To the closure time, it is possible to indication all of the needed documents and you can shell out any left costs otherwise down repayments. Immediately after which is complete, the loan is signed, and you can commercially name your self a resident!

Benefits associated with Refinancing with Sierra Pacific Mortgage

For those who already individual a house, refinancing that have Sierra Pacific will save you currency by securing less rate of interest, merging loans, if not pulling out guarantee for other monetary means. Cash-away refinancing allows you to tap into your residence’s value having things like renovations or paying high-desire loans.

First-Time Homebuyer Programs

To have first-date people, Sierra Pacific also offers special applications that come with deposit advice, easier credit criteria, and versatile financing possibilities. Such applications are created to generate homeownership accessible to those who might not be eligible for old-fashioned money.

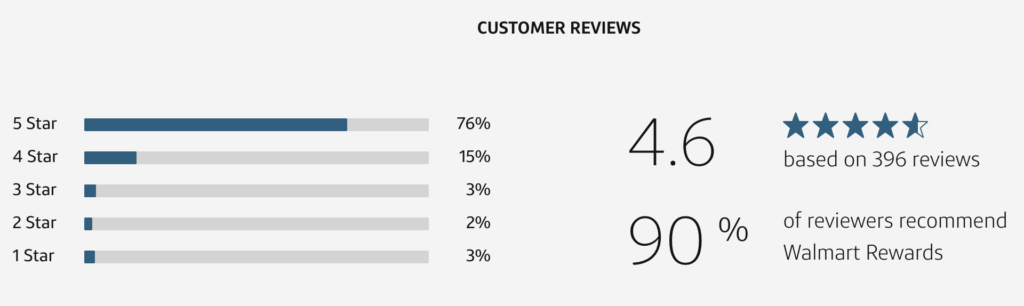

Customer Evaluations and you can Feedback

What exactly do real users must say? Sierra Pacific Home loan continuously receives large marks for its support service, aggressive costs, and you can simple loan procedure. Of several consumers enjoy brand new clear communication and service it discover through the their house-purchasing excursion.

How to Control your Home loan On line

When your mortgage try signed, dealing with it isn’t difficult. Sierra Pacific’s on line webpage enables you to build repayments, track the loan balance, and discover statements. Having access to the loan info anytime guarantees your stick to greatest away from payments and get away from late fees.

Achievement

Sierra Pacific Financial also provides a great deal of options for homeowners, regardless if you are only getting started or looking to refinance a current financing. Having competitive costs, many mortgage issues, and you may exceptional customer support, Sierra Pacific is actually a dependable lover in your homeownership travels. Willing to start-off? Extend now and commence the trail so you’re able to owning your dream household.

Faq’s

The loan techniques may take from around 30 so you’re able to 45 days, depending on your financial situation and how quickly you could potentially render the desired documents